Comparison of Swiss online payment providers for the year 2022

Finding the right payment provider for an online store can be difficult, but it is immensely important. To make it easier for you, this article will give you a detailed comparison between eight payment service providers.

The largest payment service providers (PSPs) for Swiss online stores are analyzed, as well as two smaller options - namely Datatrans, PayPal, Payrexx, PostFinance, Stripe, wallee, Worldline and zahls.ch.

To do this, we first clarify some terms, perform a cost analysis, and then evaluate the individual providers in detail. Finally, you will receive information about which payment service provider is best suited for you.

Online payments: Theory for understanding

To accept payments in the online store, merchants need an acceptance contract with an acquirer and a processing contract concluded with a payment provider.

What is a payment service provider (PSP)?

Payment service providers are companies that take care of the technical connection of online payment methods for online stores. Instead of dealing with many individual contractual partners, an online merchant who chooses a payment provider only has to negotiate with this provider in order to integrate the desired payment methods, such as Mastercard, Visa, PayPal, PostFinance and TWINT, into his store.

What is a payment provider?

A payment service provider provides many external means of payment with which a transaction can be carried out. Companies that offer this option themselves are called payment providers. This can be in card form like MasterCard and VISA or in wallet form like Google Pay or TWINT.

What is an acquiring or acceptance agreement?

Acquiring in banking is the process of acquiring contractual partners who are willing to accept payments by credit card. The acquiring bank is the credit institution that settles card payments for merchants. Merchants can conclude an acceptance contract with acquirers such as Worldline, Concardis or PostFinance or with a payment facilitator such as Payrexx.

What is a payment facilitator?

A payment facilitator, also called a collecting PSP, is in direct contact with the merchant and manages the merchant's account with the acquirer. The payment facilitator can therefore sign the acceptance contract on behalf of the acquirer, making it easier to set up online payments because the merchant has fewer direct relationships to maintain.

How to choose the right provider?

It is crucial for merchants to keep costs as low as possible. It is important to look at the setup and monthly costs, as well as the transaction fees. Furthermore, before making a decision, it should be clarified which payment methods and tools are needed for the online store. Depending on the provider, all important payment methods* are supported and integrated tools are available. It is also of central importance for merchants and their customers that payment processing is secure. Compliance with PCI DSS Level 1 standards is significant in this regard.

It is advisable to select a payment provider that is also an acquirer or payment facilitator so that merchants have a single point of contact for both. Other important points are the provider's customer support and the offer of plug-ins to well-known store solutions.

Cost analysis

Online stores with a monthly turnover of 20'000 CHF

The cost analysis shows the monthly fees for smaller online stores with a trade turnover of CHF 20,000 with 200 credit card transactions per month. This results in an average price of CHF 100 per purchase.

Price calculation

In order to perform the cost analysis, the most favorable offers of the individual payment providers were selected for a trading volume of CHF 20,000 per month. The price information is largely taken from the websites of the corresponding payment service providers.

Notes

The diagram does not include any facility costs.

Up to a turnover of 5'000 CHF, transaction fees are included in Worldline's E-Commerce Large package. Transactions exceeding this volume are charged with a percentage fee of 2% and fixed costs of 0.1 CHF.

With the Get Started offer from Datatrans, additional acquiring costs are added. Since the percentage fee is not publicly available, a value of 2% was assumed (average of all other providers).

Conclusion: Costs for smaller online stores

Payrexx has the lowest fees, closely followed by wallee. With costs of CHF 790, PayPal is the most expensive for online stores with this volume. The absolute price difference between Payrexx and PayPal is 421 CHF. Consequently, the costs are more than 50% lower for the cheapest payment provider Payrexx than for the most expensive offer.

Online stores with a monthly turnover of CHF 100,000

The cost analysis shows the monthly fees for medium-sized online stores with a trade turnover of CHF 100,000 at 1,000 credit card transactions per month. The average value of a transaction is therefore CHF 1,000.

Price calculation

In order to perform the cost analysis, the most favorable offers of the individual payment providers were selected for a trading volume of 50,000 per month. The price information was largely taken from the websites of the corresponding payment service providers.

Notes

The diagram does not include any facility costs.

Up to a turnover of 5'000 CHF, transaction fees are included in Worldline's E-Commerce Large package. Transactions exceeding this volume are charged with a percentage fee of 2% and fixed costs of 0.1 CHF.

Additional acquiring costs are added to the Datatrans scale-now offer. The average value of the first chart was reduced by 0.5 %.

Conclusion: Costs for medium-sized online stores

Payrexx is the cheapest provider with costs of CHF 1,549 per month, followed by wallee. For medium-sized online stores, PayPal and Stripe are significantly more expensive than the other providers. Payrexx is CHF 2,401 cheaper than the most expensive provider PayPal, which represents a percentage price difference of 60%.

No calculation was made for large online stores, as most payment providers each offer non-public special conditions for larger customers - these include Datatrans, Payrexx, Stripe, wallee, Worldline and zahls.ch.

Overview table

If you run an online store, it is of high importance that you can offer a variety of different payment methods. In the table you can see which payment provider provides which means. The most common means in Switzerland are listed.

In the second part you will see which software you can use to set up your store. In addition to the well-known solutions, there are also some providers that provide their own store system, the setup of which does not require any programming knowledge. In the table, such offers can be found in the line "Integrated e-commerce tools". This tool allows you to easily create a store for products, coupons, subscriptions or donations.

Lastly, you will find an overview of the publicly available reviews of the companies on Google. Also important is the number of reviews, which can represent a broader opinion.

All payment providers in detail

Payrexx: Payment facilitator with integrated e-commerce tools

Payrexx is both a payment provider and a payment facilitator and thus represents a modern and user-friendly option as an all-in-one solution due to a favorable pricing model and the number of payment interfaces and e-commerce tools. With its diverse tools, such as payment link, One Page Shop with its own URL, virtual terminal, QR Pay and digital invoices, Payrexx meets the individual requirements of almost every merchant. Payrexx is suitable for the sale of products, services, online tickets or vouchers as well as for the collection of membership fees or the implementation of donation projects. Thanks to the 30-day trial period, the platform can be tested free of charge. Payrexx has an average Google rating of 4.5 out of 5 stars with a total of 96 reviews.

Price overview of Payrexx

* Preferential rates between 1.7 % and 1.3 %

What do retailers need to do for integration?

Since each merchant gets a payment website with its own Internet address, neither integration nor programming skills are required. If you already have a store, you can enable payment with one of the plugins available for free.

PostFinance Checkout All-in-One: a fully comprehensive e-payment solution

PostFinance enjoys a high level of customer acceptance in Switzerland. PostFinance Checkout is a payment solution that offers all common payment methods (PostFinance e-finance, PostFinance Card, TWINT as well as Visa and Mastercard) as well as various store plugins. The prices listed below already include all costs for payment providers and acquiring, as no additional contracts are required. PostFinance also offers the possibility to test the provider during 30 days in a simulation mode.

Price overview of PostFinance Checkout All-in-one

What do retailers need to do for integration?

PostFinance Checkout is available to all companies domiciled in Switzerland or the Principality of Liechtenstein that have a CHF business account with PostFinance.

Worldline (formerly SIX Payments): Acquirer and payment provider

Worldline offers both acquirer and payment provider services and therefore usually provides the offers as a package. With the SIX goCard e-commerce package, payments can be processed directly via a payment window. Transfers are possible in more than 20 currencies. Accordingly, customers are relatively free to decide in which currency they would like to pay. This is also because Worldline, like most other payment providers, provides the so-called Dynamic Currency Conversion (DCC). In addition, Worldline offers various payment functions, such as the subsequent debit or the posting of partial amounts. Worldline has an average Google rating of 2.4 out of 5 stars with a total of 237 reviews.

Price overview of Worldline

Up to the selected volume, the transaction fees are included in the monthly fixed costs. All transactions exceeding this volume will be charged with the conditions of the last column.

What do retailers need to do for integration?

No programming knowledge is required. According to its own statement, SIX goCard is especially suitable for existing e-commerce solutions and static websites.

Datatrans: provider with a lot of experience

Datatrans is the largest provider in Switzerland and can be integrated both as an external payment option (external payment window) and directly through an implementation (via API in the store layout). With Datatrans Payment Pages, merchants have access to all payment methods with a single integration. Datatrans Secure Fields fit seamlessly into the design and help to improve the merchant's conversion rate. Besides, this provider also has the option to create a trial account. Datatrans has an average Google rating of 4.9 out of 5 stars with a total of 14 reviews.

Datatrans price overview

The monthly costs and the transaction fees can be seen on the website, but the setup costs cannot be found there. In addition to the costs of Datatrans, there are external acquiring fees of about 2%.

It is important to note that the minimum billing per month is CHF 290 (excluding external acquiring costs).

What do retailers need to do for integration?

Either you need developer skills or you implement a standard store system. Since Datatrans is neither an acquirer nor a payment facilitator, merchants need acceptance agreements with other acquirers.

PayPal: an international payment provider

PayPal is a simple solution for store owners, but costs more in the long run for larger order quantities. Payment link and email invoices as well as various plugins are available. According to its own information, the payment facilitator PayPal has more than 240 million active users and offers the possibility to make payments in over 100 currencies. PayPal is not a Swiss company, but has offices in San Jose as well as Luxembourg. Since PayPal is an international provider, a merchant can choose from a variety of different languages the one they want. PayPal has an average Google rating of 1.8 out of 5 stars with a total of 6 reviews.

Price overview of PayPal Switzerland

PayPal does not charge a setup fee, nor does it charge a monthly subscription fee. The cost per transaction is 3.4% of the transaction volume and 0.55 CHF transaction fee.

What do retailers need to do for integration?

To use PayPal, merchants must provide company information as well as a commercial registration number. Developer knowledge is not required.

Stripe: Provider for developers

Stripe offers developer-friendly tools for connecting payment processor services to various web and mobile apps with modern design. It enables credit card payments and also offers some other popular payment methods, such as Alipay. Stripe, like Payrexx and PayPal, is a payment facilitator. Basically, this provider is especially attractive for smaller online stores due to the prices.

Stripe price overview

The transaction fees are 2.9% and 0.3 CHF per transaction. There are neither one-time setup costs nor fixed monthly fees. No additional fees are charged for refunds.

What do retailers need to do for integration?

The merchants must have developer know-how for the implementation. Furthermore, a valid photo ID and a company number are required for verification.

wallee: Omni-Pay provider from Switzerland

Walle is a Swiss payment provider based in Winterthur. Over 1,000 customers trust this company. Payments can be made online either integrated on the website or via redirection. The templates can be changed as desired using a resource editor and plugins for various store systems are also available. A test mode is also available.

Price overview from wallee

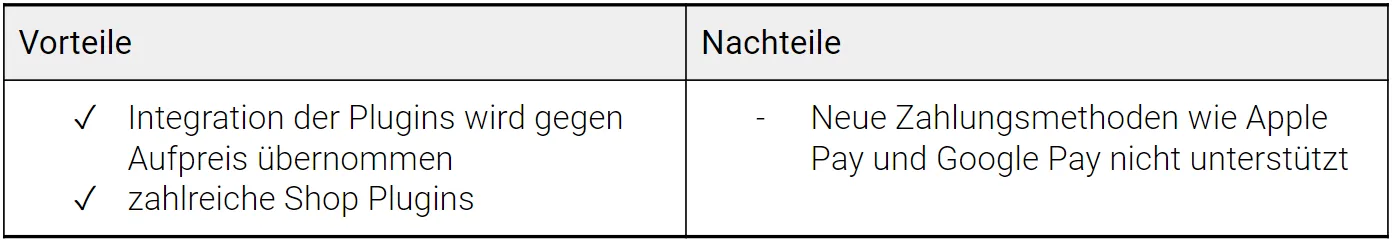

What do retailers need to do for integration?

To use one of the many integrations, programming skills are required.

zahls.ch: New Swiss payment solution for the web

zahls.ch is a Swiss provider whose offer is very clearly designed. In addition to classic payments, e-commerce tools are also available. These include payment link, digital invoices, online terminal and a self-configurable payment page (small online store). zahls.ch provides all Swiss payment methods and a large selection of foreign payment methods. zahls.ch has an average Google rating of 5 out of 5 stars with a total of 10 reviews.

Price overview from zahls.ch

What do retailers need to do for integration?

Programming skills are not necessary to use zahls.ch. On the contrary - you can easily create an online store with the integrated tool. The verification process includes the presentation of a photo ID and, if available, the entry in the commercial register.

Conclusion: Which payment provider is suitable for you?

Basically, it is recommended to start with low-cost options and then respond to the needs of the customers and expand if necessary. For young and digital companies, Payrexx is suitable ahead of wallee, Worldline and Datatrans. The cost leader for medium-sized online stores is Payrexx followed by wallee. PayPal, on the other hand, charges relatively high transaction fees and Worldline has expensive monthly fixed costs.

Of course, not only the prices have to be considered, but also the range of functions and supporting services. The most versatile and useful tools are offered by Payrexx and zahls.ch.

With over 200 payment methods (via integrated third-party providers), Payrexx offers the widest range of payment methods, followed by Datatrans with over 40 different payment methods.

In terms of ease of installation, PayPal, Payrexx and zahls.ch outperform the other payment providers. In general, Stripe is more comprehensive in its implementation than the other providers. With PostFinance, you need advanced developer skills to install the plugins.

The possibility of testing the provider and its functions in a free phase is of great advantage to the merchant, as it allows him to ensure that the payment provider meets his needs. Datatrans, Payrexx, PostFinance, wallee, Worldline and zalhs.ch allow customers to test the provider.

Datatrans, PostFinance and Worldline have the most experience in the field of payment service providing.

In summary, when choosing a payment provider, it is worth not only looking at the large and well-known providers, but also keeping an eye on the new digital payment providers. This is because these are often cheaper, but still offer a variety of tools and can cater to the individual needs of each merchant. For smaller and medium-sized stores, Payrexx and wallee are very well suited, whereas it can be worthwhile for larger companies to look at the larger providers who have a lot of experience. Basically, Payrexx is clearly one of the frontrunners in the areas of price, variety and simplicity.

Sources

Prices

Datatrans, PayPal, Payrexx, PostFinance, Stripe, wallee, Worldline, zahls.ch

Plugins for store systems

Datatrans, PayPal, Payrexx, PostFinance, Stripe, wallee, Worldline, zahls.ch

Means of payment

Datatrans, PayPal, Payrexx, PostFinance, Stripe, wallee, Worldline, zahls.ch

Icons

Legal (as of February 2022)

We do not guarantee the accuracy, completeness, timeliness or quality of the data and information provided on this website. In particular, it is important that you obtain the information about the prices and any additional costs from the respective providers.

We expressly reserve the right to change the data provided on this website or our entire offering at any time without separate notice. Likewise, we are entitled to supplement or delete this Internet site at any time or to discontinue its publication temporarily or permanently.

This article may be freely copied.

Author

Author & Author: Sven Otziger, Payrexx AG and Priscilla Wyss, formerly Payrexx AG