Create QR-bill

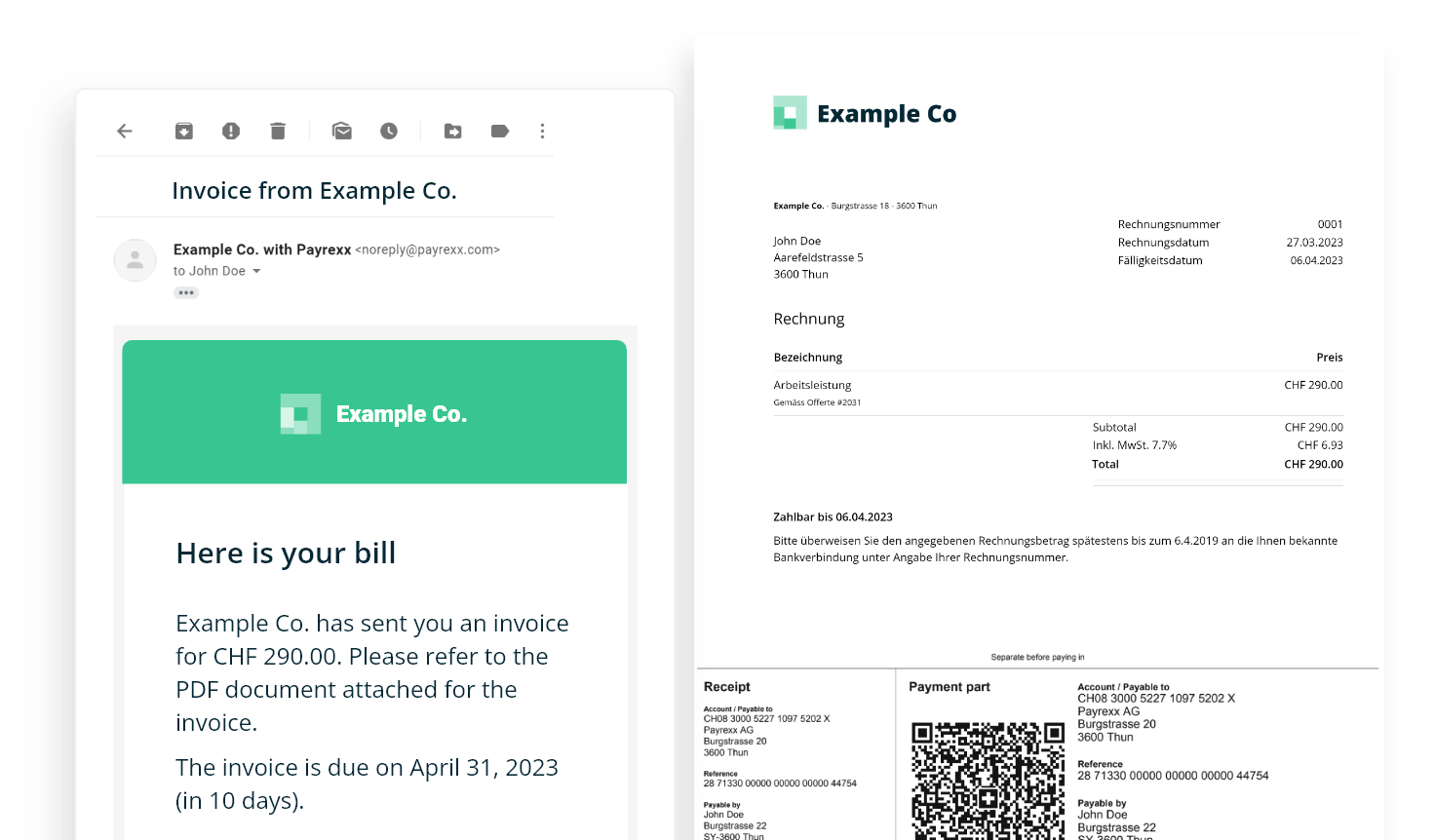

In just a few steps, you can create and offer QR-bills as a payment method with Payrexx. Simply create QR invoices in your dashboard and integrate them into your webshops. When your customers purchase your offer, they will receive a QR-bill by email. As soon as this has been paid, we will transfer the amount to you with the next payout.

Simply

With Payrexx, creating and setting up a QR-bill is very easy. You can create it quickly and easily via your dashboard. Then all your customers have to do is scan it with their smartphone and pay.

Efficient

As a merchant, you can configure your QR-bill according to your wishes when creating it with Payrexx. Your customers then do not have to enter their account and reference number manually, which makes the payment process faster and minimizes the likelihood of errors.

Smart

The easiest way to pay the QR-bill is via smartphone: your customers open their banking app, scan the QR code with the QR reader function and can then initiate the payment with just one tap.

QR-bill functions for online stores

Currencies

Payments

CHF

Payout currency

CHF, EUR

Availability

Switzerland

Transaction fees

... - FREE plan

... - STANDARD Plan

... - PREMIUM plan

More

Limit per transaction

CHF 20,000(Payrexx Pay)

Payments

Payout to Your Bank Account

Weekly Payout Intervals

Monthly Payout Intervals

Downloads

Price list (DE)

Price list (EN)

Price list (FR)

Price list (IT)

Documentation

Advantages of QR-bill

For you as a merchant

The introduction of the new standard for invoicing in Switzerland on white paper brings considerable advantages. This approach not only enables simpler payment reconciliation, but also significantly reduces manual effort. The electronic transmission of all payment information further simplifies the process and helps to minimize errors.

One notable aspect of this innovation is the elimination of the need to order pre-printed payment slips. Payrexx offers the flexibility to offer all common payment methods in Switzerland together with QR-bill for online stores. This means that businesses and consumers can continue to use their preferred means of payment.

Another major advantage is the low transaction fees, especially for larger amounts. This makes the QR-bill a cost-effective solution for companies and individuals who regularly need to process large payments.

For Your Customers

The QR-bill offers a simple way to process payments efficiently. The easiest way to do this is via the banking app on your smartphone, where you can scan the QR code with the QR reader function and then initiate the payment with a tap of your finger (and a password for approval if necessary). This eliminates the need to manually enter account and reference numbers, speeds up the payment process and minimizes sources of error.

The QR-bill supports invoicing in both CHF and EUR and offers a single QR code for all payment types and references. The digitization of data enables more efficient payment processing and monitoring, improves data quality through precise information in a standardized form and automates payment references from ordering party to recipient. This simplifies invoice processing, reduces errors during scanning and saves time and money thanks to less manual effort. The QR-bill supports both digital payments and payments by post or at the post office counter.

Other payment options

How to activate QR-bill

Existing customer

Log in to your Payrexx account and activate QR-bill in your payment provider settings. You can also offer TWINT for later payment in the same way. Together with PostFinance, Mastercard, Visa, Reka, Google Pay and other payment methods.

Not a customer yet?

Create your Payrexx account at the click of a button and test Payrexx without obligation. QR-bill is already activated for Swiss merchants and you only need to have your account verified before you can receive live payments with QR-bill.

Frequently asked questions about creating a QR-bill

-

The transaction fee for merchants who accept payments with QR-bill at Payrexx is only 0.5% of the transaction amount.

Creating the QR-bill in the Payrexx dashboard is free of charge.

-

The fees are charged to the recipient's account. For the recipient, the creation of the QR-bill is free of charge, the fee per transaction is only 0.5 % with Payrexx.

-

QR-bills for private individuals can also be created quickly and easily via your Payrexx account. To do this, simply go to Create QR-bill, create a corresponding code and send it to the person in question. You can then accept payments immediately.

-

The QR-IBAN is a special IBAN (International Bank Account Number) for use on QR-bills with a QR reference. You will receive your QR-IBAN from your bank.

-

Activating QR-bills for online stores is extremely quick and easy with Payrexx. No lengthy registration procedures are required. You can also benefit from our free open source Payrexx plugins.

This allows you to smoothly integrate QR-bill into your online store project.

Further information on the implementation of QR-bill in the most popular e-commerce systems:

QR-bill via Payrexx and WooCommerce integration

QR-bill via Payrexx and Shopware integration

QR-bill via Payrexx and Shopify integration

QR-bill via Payrexx and Prestashop integration

QR-bill via Payrexx and MyCommerce integration

QR-bill via Payrexx and Magento integration

QR-bill via Payrexx and Gambio integration

Also with our customized system: Payrexx Merchant:inside API

-

Setting up QR-bills with Payrexx is extremely quick and easy. No lengthy registration procedures are required. You can also benefit from our free open source Payrexx plugins.

This allows you to smoothly integrate QR-bill into your online store project.

Further information on the implementation of QR-bill in the most popular e-commerce systems:

QR-bill via Payrexx and WooCommerce integration

QR-bill via Payrexx and Shopware integration

QR-bill via Payrexx and Shopify integration

QR-bill via Payrexx and Prestashop integration

QR-bill via Payrexx and MyCommerce integration

QR-bill via Payrexx and Magento integration

QR-bill via Payrexx and Gambio integration

Also with our customized system: Payrexx Merchant:inside API

-

If you integrate QR-bill for merchants with Payrexx in your webshop, we guarantee you the greatest possible security for every transaction. Payrexx enables the following security precautions when integrating the QR-bill payment method:

Personal data, both yours and that of your customers, is stored on secure Swiss servers in compliance with the GDPR.

Payrexx is fully PCI DSS Level 1 certified, the highest global security standard for payment data, developed in cooperation with several credit card organizations.

To ensure secure data transmission, Payrexx uses encryption protocols such as SSL (Secure Socket Layer) with 256-bit encryption, the highest security standard.

The 3-D Secure process strengthens online payments with additional identification, minimizes fraud risks and chargebacks, and ensures maximum security and customer authentication.

Within just 5 minutes, you can accept your first online payments securely and easily with Payrexx and QR-bill for merchants.